.jpg)

Off to college? Here are some important tips for managing your money while you are away!

- Choose a bank and set up a checking account.

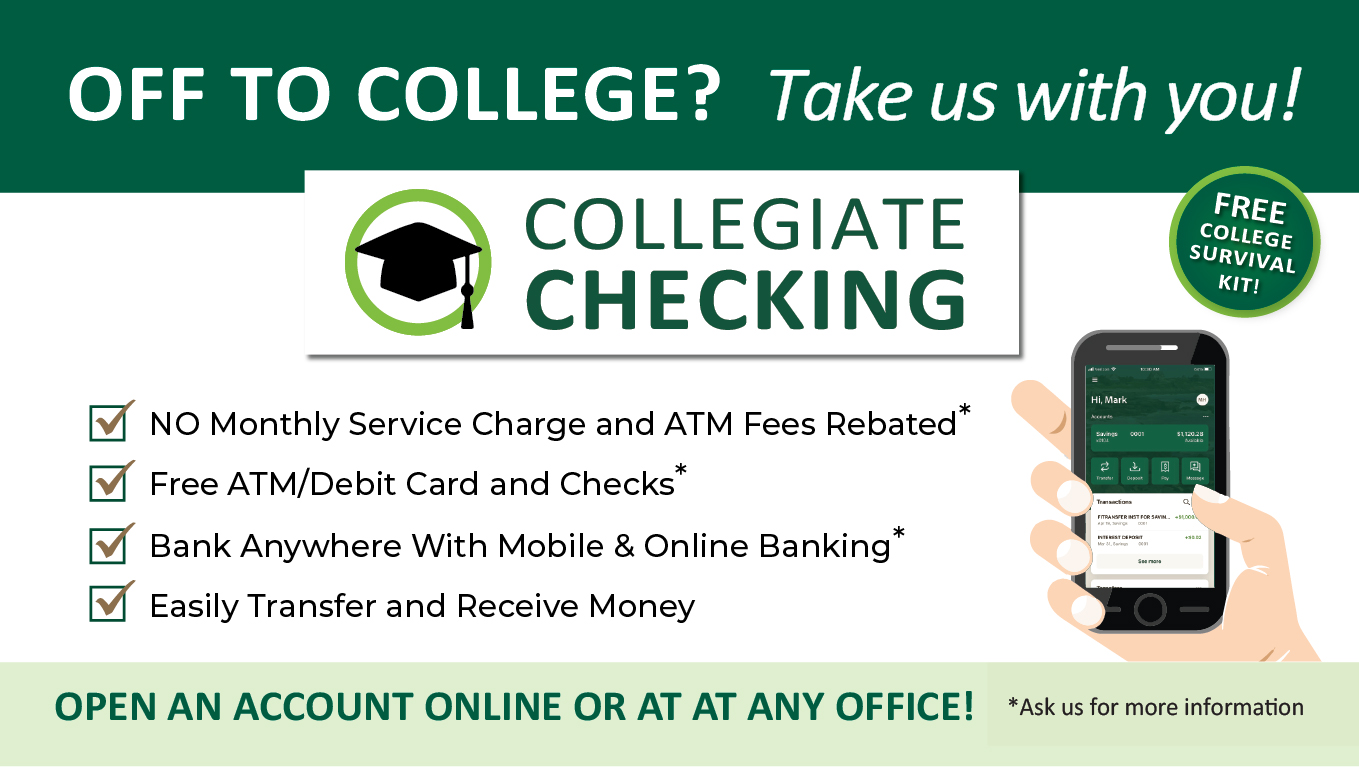

A checking account is essential for college students – even if you don’t see yourself using checks! A checking account is perfect for depositing and withdrawing money for every day expenses. You also get a debit card tied to the account to use for point-of-sale purchases (including using your mobile wallet) and withdrawing money from an ATM. Look for one with no or low fees and free ATM withdrawals – also, find a bank that has mobile deposit so you can deposit checks right from your phone. The Institution for Savings also has a ‘pay a person’ feature, so that you can transfer money back to individuals as needed! Check out our Collegiate Checking account(Opens in a new Window).

DOWNLOAD THE GUIDE!

- Create a budget.

This is important! List monthly income sources include savings, wages and parental allowances, and then write down estimated expenses for the month. It isn't easy to identify college living expenses in advance but try. Take costs such as school supplies, food outside your meal plan, personal care items and laundry into account. Then, try managing your budget and tracking expenses using an online personal finance management tool (some great options) (Opwhich helps you easily create and stick to a budget. - Use, don't abuse, credit cards.

College is a great time to start building good credit (which is crucial for leasing an apartment, purchasing a car or even landing a job after graduation). Be careful, it’s easy to get carried away and amass a large amount of debt quickly. It's important to understand the difference between credit building and overextending. - Know the difference between wants and needs.

Is $40 a week for gas a ‘need’ or a ‘want'? How much should you budget for non-meal plan food? How much will laundry cost? After a few months on campus and tracking expenses, it becomes easier to distinguish wants from needs and put a plan into action. Some students give themselves a weekly cash allowance rather than carry a debit card, and when that week's allowance is gone, they wait until next week for more ‘wants’. - Protect your personal information.

- Don’t give someone else the opportunity to spend your money or use your credit!

- Never give anyone your Social Security, credit card, or bank account numbers unless you know why the individual or organization is requesting them.

- Be sure to ignore and delete emails requesting personal information.

- Shred anything with your name, address, credit card information, or bank account numbers before putting it in the trash or recycle bin.

- Keep your security software updated and NEVER send any personal information via a computer unless it is a well-established secure site.

- Keep your credit card and ATM receipts in a safe place until you’ve paid the credit card bill or balanced your checking account.

- Keep track of how much money you have in your account.

If you write a check for more money than you have in your account, the check will bounce and your bank will charge you an overdraft fee, which may be as high as $40 per check depending on where you bank. The same goes for using your debit card when you’re out of money. Bounced checks also can hurt your credit history. To avoid bouncing checks, always record your ATM withdrawals and checks into your checkbook register or on your smart phone and subtract it from your balance. And don’t assume your account balance at the ATM is correct. If you made purchases that haven’t been processed by the bank yet, the ATM balance will be higher than the amount of money you really have. And enroll in Internet Banking so you can check your activity and balance regularly. - Take advantage of student discounts.

Going to the movies, riding the bus, or even ordering pizza might cost less if you show your student I.D. Other ways to take advantage of your student status and save money include buying used textbooks or buying books discounted online and receiving free or low-cost health care at campus health centers. - Avoid Credit Card Pushers with Too-Good-To-Be-True Offers.

Many times, colleges and universities allow vendors that promote credit cards to set up on campus. These vendors offer everything from free T-shirts to duffel bags if students will apply for their card. Don’t be fooled, make sure you understand the terms before you sign up. - Resist peer pressure.

Many students report that they sometimes feel pressured by college friends to spend money that they don’t have. Be willing to say “No, I can’t afford to do that.” Many students don’t have much money, but sometimes they are unwilling to admit it. Your willingness to be honest and live within your means sends a strong message to your friends that you are both confident and responsible. - Remember: money is important, but it’s not everything.

Good friends, strong values and work you enjoy count for more than all the money in the world. Money is only a vehicle to help you get where you want to go. Manage it well: cut the little expenses that add up, and watch your money grow as you save and invest. This way, you’ll feel a sense of accomplishment and your money will help you reach your goals.

As always, please contact us with any questions or concerns.